In this blog post, we’ll explore the importance of getting a head start on your retirement savings, how to assess your future financial needs, and the benefits of working with a retirement planning professional.

We’ll also cover the necessity of regularly updating your plan and understanding the different sources of retirement income. Whether you’re just beginning your career or already thinking about the retirement years, this article will provide valuable insights to help you along the way.

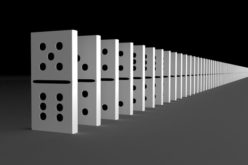

Early Retirement Planning

Starting retirement planning early allows you more time to accumulate savings and take advantage of compound interest. Investing in retirement accounts like a 401(k) or IRA early on can mean the difference between a comfortable retirement and financial struggles.

Additionally, early planning gives you the flexibility to make adjustments as your financial situation changes over time. It also helps in identifying potential gaps in your current financial strategy that could impact your future.

Working with a retirement planning professional early can provide personalized advice tailored to your specific financial goals.

Assessing Your Retirement Needs

Understanding your future needs is a crucial part of retirement planning. This involves estimating how much money you’ll require to maintain your desired lifestyle after you stop working.

Consider factors like healthcare costs, living expenses, and any other financial obligations you might have. Living longer means more years in retirement, so it’s important to plan for longevity.

A retirement planning professional, like those atStravolo Wealth Management, can help you calculate these needs, taking into account inflation and other economic variables that could affect your savings.

Retirement Planning Professionals

A retirement planning professional offers expertise and a structured approach to secure your financial future. These professionals can help you understand the different types of retirement accounts and the benefits of each.

They assist in creating a diversified investment portfolio to minimize risks and maximize returns. Retirement planners also provide insights into tax-efficient strategies to help you retain more of your savings.

By working with a professional, you gain a knowledgeable partner who can help you navigate the complexities of retirement planning.

Periodic Planning

Retirement planning is not a one-time task but a dynamic process that requires ongoing review and adjustments. As your financial situation changes due to increased earnings, family responsibilities, or market fluctuations, your retirement strategy should also evolve.

Regularly reviewing your plan ensures that you are on track to meet your retirement goals. meeting with a retirement planning professional periodically can help you reassess and adjust your plan as needed, ensuring that it remains aligned with your long-term objectives.

Additionally, keeping your plan updated helps in mitigating risks and seizing new opportunities for growth.

Retirement Income Sources

Identifying the various income sources available to you during retirement is essential. Common sources include Social Security benefits, pensions, personal savings, and investment income.

Each of these sources has its own set of rules and potential tax implications. Understanding how they work together can help you create a more reliable income stream for your retirement years.

A retirement planning professional can offer guidance on how to optimize these income sources to ensure a steady and sufficient cash flow in retirement.

Starting early and working with a qualified retirement planning professional can pave the way for financial security in your golden years.

other related articles of interest:

Understanding the Basics of Retirement Planning

Retirement Planning: Mistakes People Make and Their Solutions

By understanding your future needs, adjusting your plan over time, and leveraging various income sources, you can build a comprehensive strategy that aligns with your long-term goals.

Remember, retirement planning is an ongoing journey—stay proactive and regularly review your plan to adapt to any changes in your financial landscape. With careful planning and the right guidance, you can look forward to a comfortable and fulfilling retirement.

Image Credit: when to start retirement planning by envato.com

end of post … please share it!

end of post idea for home improvement

view and analyze home improvement ideas at our LetsRenovate center

Helpful article? Leave us a quick comment below.

And please give this article a rating and/or share it within your social networks.