Buying Food Today?

tips to increase savings

If you're thinking of cutting up your credit cards, hold on! There are some nifty credit card programs that can reward you immensely if you manage it correctly. Using a little self-discipline and changing the way you shop, you can build a down payment for a car or plan a fabulous trip by making simple purchases like food.

Page Topics:

Introduction

This file contains information on managing rebate credit cards

By using Quicken® personal financial management software (PFM) to manage transactions and set aside money, can reap big rewards.

For example:

- Earn a percentage rebate on everyday purchases. Many merchants including utility companies are accepting credit cards for payment. So get something back for everything you buy.

- Learn basic accounting concepts of Quicken®. Recording your transactions and transferring the corresponding amount charged into ghost accounts teach you important budgeting and planning techniques.

- Make your money work. Since most credit cards come with a 25-day grace period, you are buying household items without paying any cash. Your money works for you until your payment due date.

- Establish a good credit history by paying your credit card charges on time. A good credit history can lower your cost of borrowing when you need it.

You can earn all of these benefits by simply changing the way you buy. Using rebate credit cards instead of your checking account, debit card, check card or cash can reap big rewards.

But remember one important note

Your benefits can be wiped out if you lose control of your credit card management. Excessive charging without allocating the savings to pay your credit card when the amount comes due means hefty finance changes. Bad fiscal policy.

Also you need to budget how much you can spend on various items. It is shown that credit card users spend about 5-8% more on purchases when use a credit card vs. cash.

Quick Summary

This article illustrates how to use Quicken® to manage your credit card transactions. Reap the awards and avoid excessive credit card fees.

- Start:

Switching to rebate (affinity) credit cards.- Rule #1:

Use rebate credit cards for purchases.

- Rule #2:

Treat credit cards like your money account.

- Rule #3:

Use Quicken® software to record purchases.

- Rule #4:

Use accounting techniques to record and transfer funds to card savings accounts.

- Rule #5:

Pay the entire credit balance each month.

- Rule #6:

Reconcile all accounts each month.

- Rule #7:

Maximize your rebate dollars.

- Rule #8:

Manage large durable purchases.

- Summarize Benefits

Starting Point

Start with three or more rebate credit cards:

a) The first credit card will be referred to as Card1. It will be a rebate credit card (affinity card) that pays or awards you a percentage (points, miles, etc.) for every dollar you charge. Use a card that pay out the greatest rebate percentage.

b) The second credit card will be referred to as Card2. It will be a similar rebate credit card that you will use only when you maximize the annual award amount specified by Card1 (or you may use both cards simulataneously to earn equal award rebates.

c) you may use other related cards (one that gives travel points, another auto purchasing points, etcs. But for this illustration, we will use two cards.

d) Each rebate card must carry the following features:

- 25-day grace period for purchases

- rebate program that is simple and easy to follow

- zero annual fee for the card

d) The third credit card or credit line will be referred to as Card3. This card will be a low rate unsecured line of credit or home equity line that can advance you cash to finance large purchases.

Use your rebate Card1 to purchase a refrigerator for example, to earn the rebate. Then use Card3 to advance yourself cash to pay off the Card1 charge.

e) Throw your other credit, department, and gas cards away. You won't need them anymore. Your will use Card1, Card2, and Card3 for everyday purchases.

See web listings for rebate credit cards.

Rules #1 - #3

Quick Summary: Rule #1

a) Both you and your spouse (and your entire family) to use the same rebate credit card for everyday purchases.

See web listings for rebate credit cards.

b) Use the card to purchase groceries, gasoline, utilities, travel, clothes, entertainment, medical, everything you need for daily living.

c) Check to see if your rebate credit card can be used to pay your mortgage, rent, and big-ticket items such as furniture, appliances, and auto loans.

Quick Summary: Rule #2

a) Treat your credit card like your money card or checking account.

b) Manage all credit card purchases in the same way you would manage your checking account purchases.

c) Before you make a routine credit card purchase, make sure there is money in your checking account to pay for each purchase transaction.

Quick Summary: Rule #3

a) Use your Quicken® software program (or other program or mobile app) to record and manage your credit card transactions.

b) If you don't have the software or mobile app, use paper ledger accounts.

Rule #4

Use your Quicken® software (or other) to setup three accounts

The softward will walk you throught the setup. You may also want to electroncially connect the card account to the card issuer for automatic download.

You will setup (or use) three accounts.

- Credit Card Account: referred to as Card1 credit

- Savings Account: referred to as Card1 savings

- Bank Money Account: for bill payment

See Article for account definitions

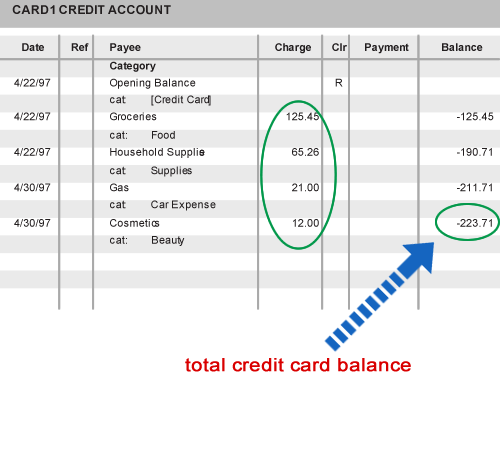

Download (or record) each credit card purchase under the “Card1 credit card account”

Open up your "Card1" account and download (or record) purchase transactions.

See illustration below

Transfer funds from your bank money account

You will next transfer funds from your money account into your "Card1 savings account" to match the credit balance in your credit card account. Use funds from your money account to transfer.

Open up your "Money Accont" and transfer funds to your "Card1 Savings Account". Your money account balance will decrease by the amount you transfer and your "Card1" savings account will increase same amount.

See illustration below

Rule #5

Reconcile your Card1 account against your month end statement

When you month-end statement comes in for your "Card1" account, reconcile your "Card1" account against your month end credit card statement. If you use electronic download, this should be done automtically. If you record card purchases, the reconciliation will make sure everything has been recorded.

See illustration below

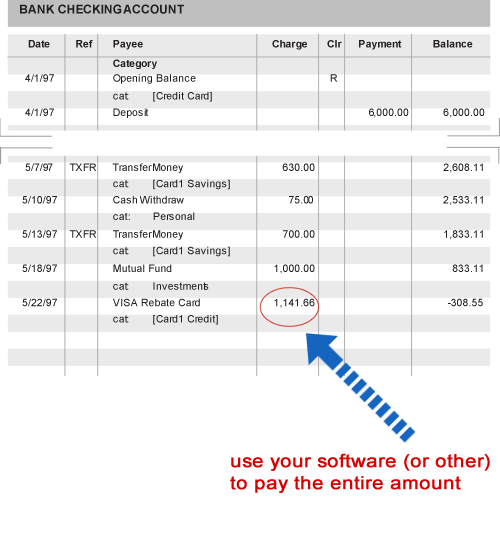

Pay the entire card balance

Use the softward to make an electronically payment or paper check to pay the entire balance of your Card1 credit balance

See illustration below

Transfer the entire balance in your "Card1" savings account to your money account

Transfer the entire balance (bring the balance to zero) in your Card1 savings account back into your money account to cover your credit card payment.

See illustration below

The difference between total savings and card payment is transfer back

Calculate the difference between money transferred into checking from the credit card payment amount. Take the difference and transfer it back into the Card1 savings account.

Example:

- Credit Card Payment: $1,144.66

(see illustration)

- Money from Card1 savings: $1,560.00

(see illustration)

- Difference transferred back $420.00 (rounded)

(see illustration)

- The difference should approximate the balance in the Card1 account.

See illustration below

Rule #6

Reconcile Card1 savings account

Reconcile your Card1 savings account after you make payment on your credit card statement. Each block of transfers into the account should reconcile against the transfers out of the account.

Everything balances to zero giving you clean accounts for the next cycle.See illustration below

Reconcile your bank checking account against your bank statement

Reconcile the transfers out of the bank checking account (transfers to Card savings account) against the transfers into the bank checking account (transfers from card savings account to pay credit card).

Everything should reconcile to zero.

See illustration below

Rule #7

Repeat the cycle each month

You will repeat Rules #4-6 each month:

- downloading your card purchase transactions

- transfering funds from your bank account to your card savings account

- reconcile accounts when the card statement comes in

- paying the entire credit card balance off

- transferring funds in the saving account back to the money account to cover the payment

- reconcile the bank and savings account

Their are two key benefits:

- you are earning rebates dollars with every spend

- when you transfer funds from your money account to your card savings account, your money account balance drops. This forces you to budget your spending similar to a debt card account.

But caution: even though the balance drops on your software, the balance remains as is on your bank statement. That is where reconciliation plays a role. You know that the balance on your bank statement is reserved for your card savings account. Don't get tempted to spend it.

Moving forward

- Use Credit Card1 for all purchases: small and large. When you have maximized the total annual rebate allowed for Credit Card1, begin using Credit Card2.

- Credit Card2 is a second credit card account with a separate “Card2 savings account.”

- Follow same rules to record and reconcile Card2 as illustrated for Card1.

Rule #8

Purchasing large ticket items

- Purchase all large ticket items with rebate credit card to earn the rebate.

- Use low-rate credit line or home equity line to advance yourself cash to finance large purchased items.

- Upon presentment of credit card statement that lists large purchases, advance yourself cash from credit line and deposit into money checking account.

- Use the cash advance and the card savings account to pay the entire amount on your credit card statement. Never carry a balance on your credit card statement. The interest rate charges are too high and future purchases on your card will be charged interest.

- When you need to finance or advance yourself cash, use a low interest rate account such as home equity line of credit, unsecured credit line, etc.

- Let’s shop around. All About Home Equity Products:

http://www.yourequity.com

Quick summary

- Earn rebate dollars on everyday purchases such as food, gasoline, utilities, etc.

- Lean the basic concepts of financial management such as budgeting and financial planning. Use techniques to plan retirement, college, financing a new home, etc.

- Money set aside in card savings account earns money. You may want to use a money market account to accumulate higher savings rate.

- Establish good credit history by paying your credit card statement on time and in full.